Already GST is on the minds of everyone in the industry of marketing and advertising. There have been many changes in the field of marketing over the last few years, with increased digital ad spends and concurrent competition stemming from lower-priced brands, now GST has changed the game ever so slightly. Previously the ad space industry was roaming on negligible tax for many years as the space was nascent and unavailable for scale. Now, with the industry growing double digits for a few years now, the tax system has arrived and there are mixed reviews.

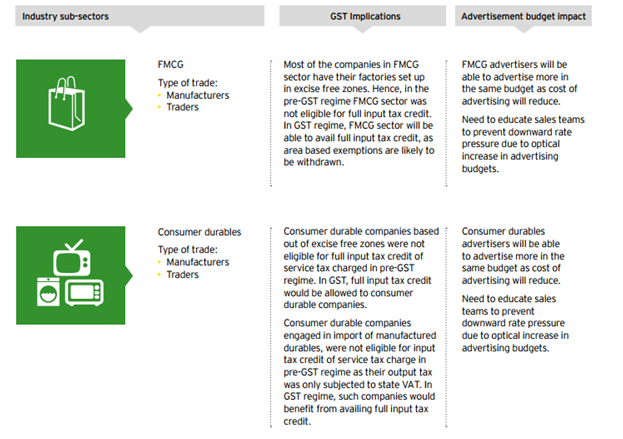

On most of the infrastructure or necessity industries there is a prediction of increased ad-spends owing to the balancing nature of ad-spends and revenue generation and tax benefits. There will be a short rise of 5-6% across the board in the FMCG, key services and basic amenities-focused startups/industries.

There is a straight 18% hit from 15% earlier on to the ad agencies to produce results with slightly smaller budgets. What this will entail in the short term is miniscule, however, in the long run, brands will try to negotiate their way into smaller ad-fees (typically in the 12-15% range for projects less than 1cr).

Luxury brands and products that are taxed higher in the current GST program will see a decrease in ad-spends owing the margins being reduced, as well as the direct impact of customer sensitivity driving spends down. Already there are many shakeups in these industries and hopefully with October-November-December season spends, there will be a rise in the diversification of spends as well.

From the industry point of view, here’s what Ashish Bhasin, Chairman & CEO, South Asia, Dentsu Aegis Networkhas to say about GST and ad-spend – “The benefit will be that the clients will have easy flow of goods, so there will be efficiencies in their business as well as some clients who were not able to get full set of the service tax, now they will be able to get. What will depend upon is also the final rate applicable? Now, service tax goes up to around 15%. The slab for our industry is not clear yet. If it falls in 12%, it will be good, if 18% then there will be bigger hit”

Also, depending on whether your brand has been setup in a tax-free zone will also change in the new GST with multi-crore businesses have to pay more for existing domains, which will impact how the advertising industry will be able to service these accounts.

A recent EY report on the impact of GST mentioned that there are two solid industries that are the clear winners in the GST’s rollout and impact on the advertising space. Agencies handling these accounts are going to benefit from next month around.

Saumin Shah, CFOHungama Digital Media Entertainment is optimistic about the transition. He states that there will be a positive impact on the overall ad space arena due to the simplification of the tax-code, reduction of inefficiencies and greater role of governance with frequent monitoring and following code. He mentions that – “The expected growth in India’s GDP by over 8% on the back of efficiencies coming out of GST roll out will lead to increase in advertising spends, with a greater pie for digital advertising. Businesses across sectors will be benefited on account of a single levy and better claim of Input tax credits, which may be ploughed back into advertising. Digital advertising will benefit the most in the overall advertising space as it continues to grow exponentially with massive increase in consumers on digital platforms”

- App Store Optimization

- Artificial Intelligence

- CakePHP

- Competitor Analysis

- Content Marketing

- Custom PHP

- Digital Marketing

- eCommerce

- eCommerce SEO

- Email Strategy

- Facebook Marketing

- Google Adword

- Google Algorithm

- Instagram Marketing

- Jobs

- LinkedIn Marketing

- Magento SEO

- Mobile Apps Development

- News

- Online Reputation Management

- Other

- Pay Per Click

- Pintrest

- Search Engine Optimisation

- Social Media Marketing

- Traditional Marketing

- Uncategorized

- Viral Marketing

- Website Design & Development

- Wix SEO

- WordPress

- WordPress SEO